Personal Savings & Money

Market Accounts

Our mission is to provide the best banking experience possible by anticipating your needs and exceeding your expectations while assisting you in achieving your short-term and long-term financial goals. We continue this mission by offering you a variety of savings options. Choose from a variety of accounts that is best for you and your savings goals.

| Account | Minimum Daily Balance1 | Account Requirements | Service Charge | Transaction Limit | Extras | |

| BNC Savings Account | $5002 | None | $6 if minimum balance requirements not met | Unlimited withdrawals in person, by mail, or at the ATM. All other withdrawals limited to 6 per statement cycle.3 | Account can be used for overdraft purposes.4 | See More > |

| BNC Rewards Savings Account

Offered in Virginia Only |

None | Must have a BNC Rewards Checking account | None | Unlimited withdrawals in person, by mail, or at the ATM. All other withdrawals limited to 6 per statement cycle.3 | Earn higher interest rates when you meet the monthly qualifications.5 | See More > |

| BNC Minor Savings Account | None | None | None | 2 withdrawals6 per month. | With each in person deposit the child will receive a gift from the BNC bird cage. | See More > |

| BNC Premium Money Market | $10,000 | None | $20 if minimum balance requirement not met | Unlimited withdrawals in person, by mail, or at the ATM. All other withdrawals limited to 6 per statement cycle.3 | See More > | |

| BNC Money Market | $1,000 | None | $15 if minimum balance requirement not met | Unlimited withdrawals in person, by mail, or at the ATM. All other withdrawals limited to 6 per statement cycle.3 | See More > |

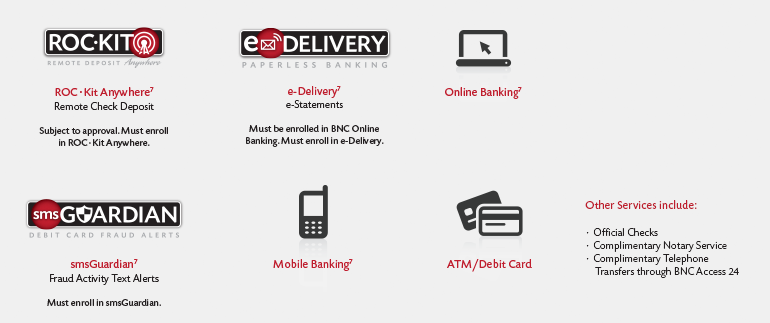

Personal Savings & Money Market Accounts may come with the following available services:

1. Required to avoid service charge

2. $500 minimum daily balance or $5,000 combined in minimum daily balance from checking, savings and money market accounts. Otherwise, if minimum daily balance is not met, there is a $6 monthly service charge.

3. Fees may apply for exceeding transaction limits.

4. $10 per transfer will be assessed to the savings account.

5. When account requirements are met. If monthly qualifications are not met in the BNC Rewards Checking account, there is no montly service change to the BNC Rewards Savings account. It earns a lower rate of interest and you may try again next month to earn the rewards.

6. Withdrawls inlcude in person, by mail and at the ATM, as well as any checks, drafts, debit card or similar order. $2.50 for each additional withdrawal.

7. Message, data, connectivity and usage rates may apply. Contact your wireless and/or internet service provider for details.

CD Rates

Certificates of Deposit

Certificates of Deposit are an excellent way to keep your money safe and secure while earning a competitive interest rate. Bank of North Carolina CDs are available in a wide variety of terms and options.

For more rate information and quotes call us today!

CD Calculator—

Individual Retirement Accounts

Bank of North Carolina offers short- and long-term IRAs. Your retirement savings can start today! Bank of North Carolina offers 4 different IRA plans: Traditional, ROTH, Simplified Employee Pension Plans (SEP), and Coverdell Education Savings Account (CESA).

The Traditional IRA

A traditional IRA is primarily an individual savings plan. Contributions are made up to a specified limit with the contribution tax deductible. Money invested and earned in a traditional IRA are subject to income taxes at the time of withdrawal. Withdrawals can be made without penalty once you reach the age of 59 1/2 years of age and you must begin withdrawing from your account when you reach the age of 70 1/2.

Deductibility for your contribution is based on IRS guidelines. All earnings on your Traditional IRA contributions remain tax deferred until you make withdrawals, and are then taxed as income for that year.

The Roth IRA

A non-deductible account that features tax free withdrawals after five years for certain distribution reasons. To qualify for a Roth IRA, you must have earned income (or your spouse must have earned income).

Simplified Employee Pension Plans (SEP)

A retirement plan that is available to self-employed individuals and small businesses. A SEP-IRA is a written plan that allows a self-employed person to contribute towards his/her retirement and to contribute towards employee’s retirements without the complexity of other plans.

Coverdell Education Savings Account (CESA)

The Coverdell Education Savings Account is a nondeductible account that features tax-free withdrawals for a very specific purpose such as a child’s education expenses. These accounts were formerly known as Education Individual Retirement Accounts (IRAs) and at first glance, a CESA may look similar to traditional or ROTH IRAs. Higher education distributions are also permitted from these accounts, but while qualified higher education distributions from a traditional or ROTH IRA are only penalty tax-free, the same distribution from a CESA are penalty-free and federal income tax-free. Consult your tax or legal professional for further information regarding state or local income tax laws.

*For additional information regarding your IRA accounts, please contact your tax advisor.

Proudly serving these communities in

NORTH CAROLINA:

Albemarle

Archdale

Asheboro

Asheville

Burlington

Cary

Oakboro

Raleigh

Chapel Hill

Charlotte

Concord

Durham

Greensboro

Harrisburg

Hendersonville

Randleman

Salisbury

High Point

Kernersville

Lake Norman

Lexington

Locust

Mooresville

North Davidson

Thomasville

Winston-Salem

SOUTH CAROLINA:

Charleston

Easley

Goose Creek

Greenville

Greer

Hilton Head Island

John’s Island

Mauldin

Monck’s Corner

Myrtle Beach

Mt. Pleasant

Murrells Inlet

North Charleston

North Myrtle Beach

Spartanburg

Summerville

Surfside Beach

VIRGINIA:

Salem

Roanoke

Vinton

© 2022 BNC Bank

NASDAQ:BNCN